Page 9 - Moreno Valley City Manager's Report for 2021

P. 9

2014 REFUNDING LEASE 2017 SUBORDINATE TAX ALLOCATION

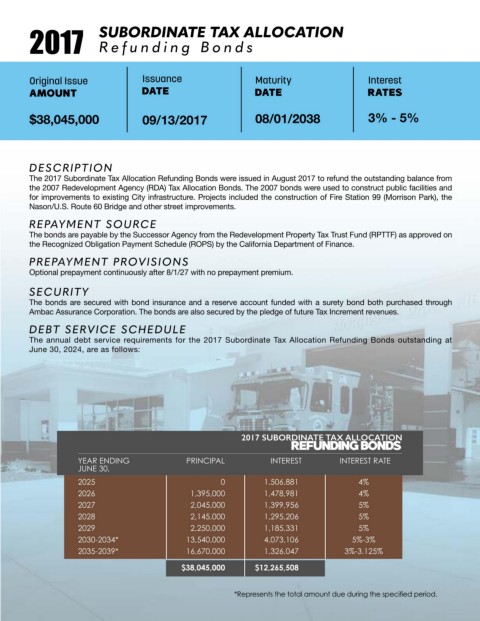

R efunding Bonds

R e v enue Bonds

Original Issue Issuance Maturity Interest Original Issue Issuance Maturity Interest

AMOUNT DATE DATE RATES AMOUNT DATE DATE RATES

$25,325,000 11/20/2014 11/01/2035 2% - 5% $38,045,000 09/13/2017 08/01/2038 3% - 5%

DESCRIPTION DESCRIPTION

The 2014 Refunding Lease Revenue Bonds were issued in November 2014 to refund the remaining portion of the 2005 Lease The 2017 Subordinate Tax Allocation Refunding Bonds were issued in August 2017 to refund the outstanding balance from

Revenue Bonds. The 2005 Lease Revenue Bonds were issued to fund the construction of improvements to various roadways, the 2007 Redevelopment Agency (RDA) Tax Allocation Bonds. The 2007 bonds were used to construct public facilities and

expansion of the Public Safety Building, construction of electric utility infrastructure and construction of Fire Station 58 for improvements to existing City infrastructure. Projects included the construction of Fire Station 99 (Morrison Park), the

(Moreno Beach). Nason/U.S. Route 60 Bridge and other street improvements.

REPAYMENT SOURCE REPAYMENT SOURCE

The repayment source for these bonds is the General Fund. The General Fund may seek reimbursement from the Development The bonds are payable by the Successor Agency from the Redevelopment Property Tax Trust Fund (RPTTF) as approved on

Impact Fee Funds and the Moreno Valley Utility as funds are available. the Recognized Obligation Payment Schedule (ROPS) by the California Department of Finance.

PREPAYMENT PROVISIONS PREPAYMENT PROVISIONS

Optional prepayment continuously after 8/1/27 with no prepayment premium.

Optional prepayment continuously after 11/1/24 with no prepayment premium.

SECURITY

SECURITY The bonds are secured with bond insurance and a reserve account funded with a surety bond both purchased through

These bonds are secured by City-owned property. This asset pool consists of the City Hall, Public Safety Building/Emergency Ambac Assurance Corporation. The bonds are also secured by the pledge of future Tax Increment revenues.

Operations Center, Fire Station 99 (Morrison Park), Sunnymead Park and John F. Kennedy Park. This asset pool is shared by

the 2013 Refunding Bonds matured in 2022 and the 2014 Refunding Bonds. DEBT SERVICE SCHEDULE

DEBT SERVICE SCHEDULE The annual debt service requirements for the 2017 Subordinate Tax Allocation Refunding Bonds outstanding at

June 30, 2024, are as follows:

The annual debt service requirements for the 2014 Refunding Lease Revenue Bonds outstanding at June 30, 2024, are as follows:

2014 REFUNDING LEASE 2017 SUBORDINATE TAX ALLOCATION

REVENUE BONDS REFUNDING BONDS

YEAR ENDING GOVERNMENTAL ACTIVITIES MORENO VALLEY UTILITY TOTAL DEBT SERVICE INTEREST YEAR ENDING PRINCIPAL INTEREST INTEREST RATE

JUNE 30, RATE JUNE 30,

PRINCIPAL INTEREST PRINCIPAL INTEREST PRINCIPAL INTEREST 2025 0 1,506,881 4%

2025 1,355,319 910,591 159,681 107,284 1,515,000 1,017,875 5% 2026 1,395,000 1,478,981 4%

2026 1,426,887 841,036 168,113 99,089 1,595,000 940,125 5% 2027 2,045,000 1,399,956 5%

2027 1,489,509 768,126 175,491 90,499 1,665,000 858,625 5% 2028 2,145,000 1,295,206 5%

2028 1,574,496 691,526 185,504 81,474 1,760,000 773,000 5% 2029 2,250,000 1,185,331 5%

2029 1,650,537 610,900 194,463 71,975 1,845,000 682,875 5% 2030-2034* 13,540,000 4,073,106 5%-3%

2030-2034* 9,460,395 1,855,199 1,114,605 218,576 10,575,000 2,073,775 5%-4% 2035-2039* 16,670,000 1,326,047 3%-3.125%

2035-2036* 4,347,756 175,699 512,244 20,701 4,860,000 196,400 4%

$38,045,000 $12,265,508

$21,304,899 $5,853,077 $2,510,101 $689,598 $23,815,000 $6,542,675

*Represents the total amount due during the specified period. *Represents the total amount due during the specified period.