Page 13 - Moreno Valley City Manager's Report for 2021

P. 13

2021 STREETLIGHT REFINANCING 2021 REFUNDING LEASE

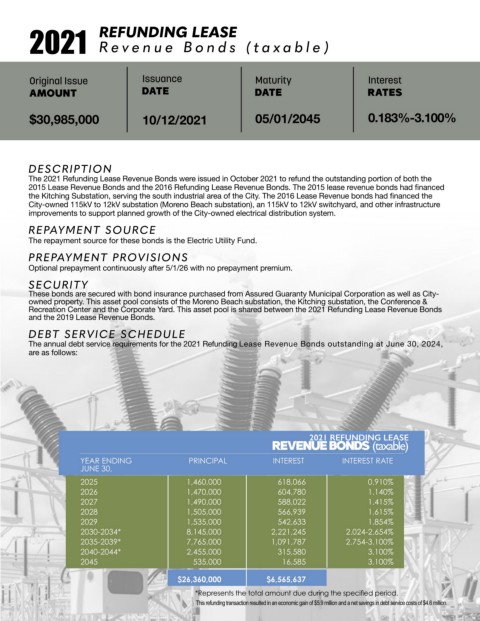

R e v enue Bonds (t ax able)

(t ax able)

Original Issue Issuance Maturity Interest Original Issue Issuance Maturity Interest

AMOUNT DATE DATE RATES AMOUNT DATE DATE RATES

$7,402,587 08/10/2021 06/01/2034 3.47% $30,985,000 10/12/2021 05/01/2045 0.183%-3.100%

DESCRIPTION DESCRIPTION

The 2021 Amended Purchase Agreement served to refinance the remaining balance of the 2018 Streetlight Financing The 2021 Refunding Lease Revenue Bonds were issued in October 2021 to refund the outstanding portion of both the

agreement. The original agreement funded the purchase of approximately 9,411 streetlights from Southern California Edison 2015 Lease Revenue Bonds and the 2016 Refunding Lease Revenue Bonds. The 2015 lease revenue bonds had financed

(SCE) and the retrofit of those lights, as well as the approximately 2,000 additional streetlights already owned by the City, with the Kitching Substation, serving the south industrial area of the City. The 2016 Lease Revenue bonds had financed the

City-owned 115kV to 12kV substation (Moreno Beach substation), an 115kV to 12kV switchyard, and other infrastructure

LED fixtures. This refinancing agreement was entered into on a taxable basis with Banc of America Capital Leasing.

improvements to support planned growth of the City-owned electrical distribution system.

REPAYMENT SOURCE REPAYMENT SOURCE

The repayment source for these bonds is the Electric Utility Fund.

The repayment source for these bonds is the Electric Utility Fund.

PREPAYMENT PROVISIONS PREPAYMENT PROVISIONS

Optional prepayment continuously after 6/1/26 with a prepayment premium (102%). Optional prepayment continuously after 5/1/26 with no prepayment premium.

SECURITY SECURITY

These bonds are secured with bond insurance purchased from Assured Guaranty Municipal Corporation as well as City-

The security for this agreement consists of the City’s streetlights.

owned property. This asset pool consists of the Moreno Beach substation, the Kitching substation, the Conference &

DEBT SERVICE SCHEDULE Recreation Center and the Corporate Yard. This asset pool is shared between the 2021 Refunding Lease Revenue Bonds

and the 2019 Lease Revenue Bonds.

The annual debt service requirements for the 2021 Streetlight Refinancing outstanding at June 30, 2024, are as follows:

DEBT SERVICE SCHEDULE

The annual debt service requirements for the 2021 Refunding Lease Revenue Bonds outstanding at June 30, 2024,

are as follows:

2021 STREETLIGHT 2021 REFUNDING LEASE

REFINANCING (taxable) REVENUE BONDS (taxable)

YEAR ENDING PRINCIPAL INTEREST INTEREST RATE YEAR ENDING PRINCIPAL INTEREST INTEREST RATE

JUNE 30, JUNE 30,

2025 506,055 201,618 3.47% 2025 1,460,000 618,066 0.910%

2026 523,769 183,904 3.47% 2026 1,470,000 604,780 1.140%

2027 1,490,000 588,022 1.415%

2027 542,103 165,570 3.47% 2028 1,505,000 566,939 1.615%

2028 561,078 146,595 3.47% 2029 1,535,000 542,633 1.854%

2030-2034* 8,145,000 2,221,245 2.024-2.654%

2029 580,718 126,955 3.47%

2035-2039* 7,765,000 1,091,787 2.754-3.100%

2030-2034* 3,223,109 315,257 3.47% 2040-2044* 2,455,000 315,580 3.100%

2045 535,000 16,585 3.100%

$ 5,936,832 $ 1,139,899

*Represents the total amount due during the specified period. $26,360,000 $6,565,637

The 2021 Streetlight Refinancing Agreement reduced the rate from the former 2018 agreement at 5.42% to 3.47%, *Represents the total amount due during the specified period.

resulting in savings of $855,000 with no extension of the maturity date.

This refunding transaction resulted in an economic gain of $5.9 million and a net savings in debt service costs of $4.6 million.