Page 21 - City of Moreno Valley Invstment and Cash Management Program

P. 21

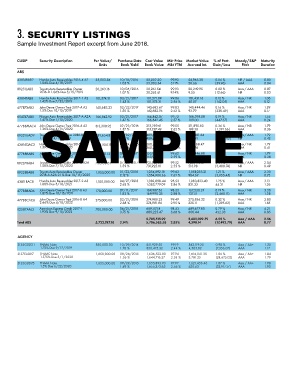

3. SECURITY LISTINGS

Sample Investment Report excerpt from June 2018.

CUSIP Security Description Per Value/ Purchase Date Cost Value Mkt Price Market Value % of Port. Moody/S&P Maturity

Units Book Yield Book Value Mkt YTM Accrued Int. Gain/Loss Fitch Duration

ABS

43814RAB2 Honda Auto Receivables 2016-4 A2 55,003.84 10/18/2016 55,002.30 99.93 54,963.38 0.06 % NR / AAA 0.80

1.04% Due 4/18/2019 1.05 % 55,003.34 3.11% 20.66 (39.96) AAA 0.04

89231LAB3 Toyota Auto Receivables Owner 20,263.16 10/04/2016 20,261.54 99.93 20,249.95 0.02 % Aaa / AAA 0.87

2016-D 1.06% Due 5/15/2019 1.07 % 20,262.61 9.14% 9.55 (12.66) NR 0.03

43814TAB8 Honda Auto Receivables 2017-1 A2 101,574.31 03/21/2017 101,571.89 99.86 101,431.16 0.12 % Aaa / NR 1.06

1.42% Due 7/22/2019 1.43 % 101,573.21 2.56 % 40.07 (142.05) AAA 0.12

47787XAB3 John Deere Owner Trust 2017-A A2 140,683.23 02/22/2017 140,682.67 99.83 140,444.46 0.16 % Aaa / NR 1.29

1.5% Due 10/15/2019 1.50 % 140,682.95 2.52 % 93.79 (238.49) AAA 0.17

654747AB0 Nissan Auto Receivables 2017-A A2A 166,842.92 03/21/2017 166,842.07 99.73 166,395.08 0.19 % Aaa / NR 1.55

SAMPLE

1.47% Due 1/15/2020 1.47 % 166,842.45 2.57 % 109.00 (447.37) AAA 0.24

47788MAC4 John Deere Owner Trust 2016-A A3 313,308.92 02/23/2016 313,259.61 99.55 311,895.83 0.36 % Aaa / NR 1.79

1.36% Due 4/15/2020 1.37 % 313,287.49 2.62 % 189.38 (1,391.66) AAA 0.36

89231UAD9 Toyota Auto Receivables 2016-B 489,654.81 05/02/2016 489,629.79 99.47 487,081.64 0.56 % Aaa / AAA 1.79

1.3% Due 4/15/2020 1.31 % 489,648.07 2.57 % 282.91 (2,566.43) NR 0.42

43814QAC2 Honda Auto Receivables 2016-2 A3 260,554.18 05/24/2016 260,549.13 99.47 259,168.47 0.30 % Aaa / NR 1.79

1.39% Due 4/15/2020 1.40 % 260,551.85 2.67 % 160.96 (1,383.38) AAA 0.41

47788BAB0 John Deere Owner Trust 2017-B A2A 153,931.12 07/11/2017 153,917.74 99.62 153,346.88 0.18 % Aaa / NR 1.79

1.59% Due 4/15/2020 1.60 % 153,922.39 2.59 % 108.78 (575.51) AAA 0.38

89237RAB4 Toyota Auto Receivable 2017-C A2A 731,930.61 07/25/2017 731,923.66 99.52 728,445.07 0.84 % Aaa / AAA 2.04

1.58% Due 7/15/2020 1.59 % 731,925.81 2.55 % 513.98 (3,480.74) NR 0.49

89238BAB8 Toyota Auto Receivables Owner 1,055,000.00 01/23/2018 1,054,892.18 99.63 1,051,053.21 1.21 % Aaa / AAA 2.30

2018-A A2A 2.1% Due 10/15/2020 2.12 % 1,054,908.66 2.62 % 984.67 (3,855.45) NR 0.73

43811BAC8 Honda Auto Receivables 2017-2 A3 1,100,000.00 04/27/2018 1,082,898.44 98.53 1,083,823.40 1.25 % Aaa / AAA 3.13

1.68% Due 8/16/2021 2.62 % 1,083,779.09 2.86 % 821.33 44.31 NR 1.26

47788BAD6 John Deere Owner Trust 2017-B A3 170,000.00 07/11/2017 169,987.56 98.55 167,530.24 0.19 % Aaa / NR 3.30

1.82% Due 10/15/2021 1.83 % 169,990.35 2.88 % 137.51 (2,460.11) AAA 1.38

47788CAC6 John Deere Owner Trust 2016-B A4 275,000.00 02/21/2018 274,980.23 99.49 273,586.22 0.32 % Aaa / NR 3.80

2.66% Due 4/18/2022 2.68 % 274,981.84 2.95 % 325.11 (1,395.62) AAA 1.85

02587AAJ3 American Express Credit 2017-1 700,000.00 06/21/2018 689,117.18 98.53 689,677.80 0.79 % Aaa / NR 4.21

1.93% Due 9/15/2022 3.75 % 689,225.47 3.68 % 600.44 452.33 AAA 0.85

5,705,515.99 5,689,092.79 6.55 % Aaa / AAA 2.56

Total ABS 5,733,747.10 2.14% 5,706,585.58 2.83% 4,398.14 (17,492.79) AAA 0.77

AGENCY

3135G0ZG1 FNMA Note 850,000.00 10/29/2014 851,929.50 99.19 843,119.25 0.98 % Aaa / AA+ 1.20

1.75% Due 9/12/2019 1.70 % 850,475.32 2.44 % 4,503.82 (7,356.07) AAA 1.17

3137EADR7 FHLMC Note 1,650,000.00 08/26/2015 1,636,522.80 97.94 1,616,041.35 1.86 % Aaa / AA+ 1.84

1.375% Due 5/1/2020 1.56 % 1,644,716.37 2.53 % 3,781.25 (28,675.02) AAA 1.79

3135G0D75 FNMA Note 1,655,000.00 09/29/2015 1,655,893.70 97.97 1,621,456.46 1.87 % Aaa / AA+ 1.98

1.5% Due 6/22/2020 1.49 % 1,655,373.63 2.56 % 620.63 (33,917.17) AAA 1.93

21