Page 15 - MVU Annual Report 2019/20

P. 15

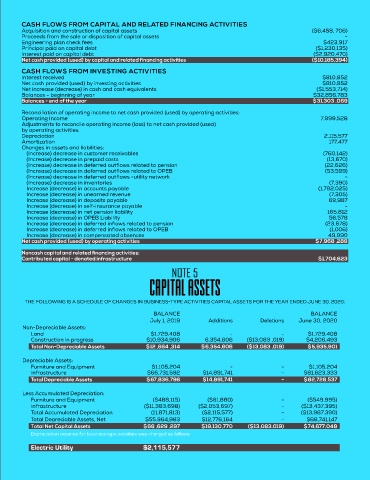

CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIES

Acquisition and construction of capital assets ($6,458, 706)

Proceeds from the sale or disposition of capital assets -

Engineering plan check fees $423,917

Principal paid on capital debt ($1,230,135)

Interest paid on capital debt ($2,920,470)

Net cash provided (used) by capital and related financing activities ($10,185,394)

CASH FLOWS FROM INVESTING ACTIVITIES

Interest received $810,852

Net cash provided (used) by investing activities $810,852

Net increase (decrease) in cash and cash equivalents ($1,553,714)

Balances - beginning of year $32,856,783

Balances - end of the year $31,303 ,069

Reconciliation of operating income to net cash provided (used) by operating activities:

Operating Income 7,999,528

Adjustments to reconcile operating income (loss) to net cash provided (used)

by operating activities:

Depreciation 2,115,577

Amortization 177,477

Changes in assets and liabilities:

(Increase) decrease in customer receivables (760,142)

(Increase) decrease in prepaid costs (13,670)

(Increase) decrease in deferred outflows related to pension (22,626)

(Increase) decrease in deferred outflows related to OPEB (53,599)

(Increase) decrease in deferred outflows -utility network -

(Increase) decrease in inventories (7,390)

Increase (decrease) in accounts payable (1,792,025)

Increase (decrease) in unearned revenue (7,305)

Increase (decrease) in deposits payable 69,987

Increase (decrease) in self-insurance payable -

Increase (decrease) in net pension liability 165,812

Increase (decrease) in OPEB Liability 56,578

Increase (decrease) in deferred inflows related to pension (23,678)

Increase (decrease) in deferred inflows related to OPEB (1,006)

Increase (decrease) in compensated absences 49,990

Net cash provided (used) by operating activities $7,968 ,288

Noncash capital and related financing activities:

Contributed capital - donated infrastructure $1,704,623

NOTE 5

Capital Assets

THE FOLLOWING IS A SCHEDULE OF CHANGES IN BUSINESS¨TYPE ACTIVITIES CAPITAL ASSETS FOR THE YEAR ENDED JUNE 30, 2020:

BALANCE BALANCE

July 1, 2019 Additions Deletions June 30, 2020

Non-Depreciable Assets:

Land $1,729,408 - - $1,729,408

Construction in progress $10,934,906 6,354,606 ($13,083 ,019) $4,206,493

Total Non-Depreciable Assets $12 ,664 ,314 $6,354,606 ($13,083 ,019) $5,935,901

Depreciable Assets:

Furniture and Equipment $1,105,204 - - $1,105,204

Infrastructure $66,731,592 $14,891,741 - $81,623,333

Total Depreciable Assets $67,836,796 $14,891,741 - $82,728,537

Less Accumulated Depreciation:

Furniture and Equipment ($488,115) ($61,880) - ($549,995)

Infrastructure ($11,383,698) ($2,053,697) - ($13,437,395)

Total Accumulated Depreciation (11,871,813) ($2,115,577) - ($13,987,390)

Total Depreciable Assets, Net $55,964,983 $12,776,164 - $68,741,147

Total Net Capital Assets $68 ,629 ,297 $19,130,770 ($13,083.019) $74,677,048

Depreciation expense for business-type activities was charged as follows:

Electric Utility $2,115,577