Page 26 - 2018-2019 MVUAnnual Report

P. 26

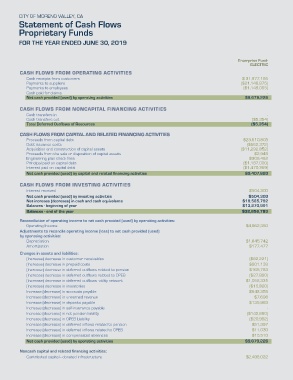

CITY OF MORENO VALLEY, CA

Statement of Cash Flows

Proprietary Funds

FOR THE YEAR ENDED JUNE 30, 2019

Enterprise Fund-

ELECTRIC

CASH FLOWS FROM OPERATING ACTIVITIES

Cash receipts from customers $ 31,977,166

Payments to suppliers ($21,148,875)

Payments to employees ($1,149,065)

Cash paid for claims -

Net cash provided (used) by operating activities $9,679,226

CASH FLOWS FROM NONCAPITAL FINANCING ACTIVITIES

Cash transfers in -

Cash transfers out ($5,354)

Total Deferred Outflows of Resources ($5,354)

CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIES

Proceeds from capital debt $23,610,803

Debt issuance costs ($562,372)

Acquisition and construction of capital assets ($11,292,852)

Proceeds from the sale or disposition of capital assets $2,948

Engineering plan check fees $306,462

Principal paid on capital debt ($1,187,000)

Interest paid on capital debt ($1,470,369)

Net cash provided (used) by capital and related financing activities $9,407,620

CASH FLOWS FROM INVESTING ACTIVITIES

Interest received $504,300

Net cash provided (used) by investing activities $504,300

Net increase (decrease) in cash and cash equivalents $19,585,792

Balances - beginning of year $13,270,991

Balances - end of the year $32,856,783

Reconciliation of operating income to net cash provided (used) by operating activities:

Operating Income $4,962,350

Adjustments to reconcile operating income (loss) to net cash provided (used)

by operating activities:

Depreciation $1,845,742

Amortization $177,477

Changes in assets and liabilities:

(Increase) decrease in customer receivables ($82,221)

(Increase) decrease in prepaid costs $901,139

(Increase) decrease in deferred outflows related to pension $165,783

(Increase) decrease in deferred outflows related to OPEB ($27,890)

(Increase) decrease in deferred outflows -utility network $1,052,331

(Increase) decrease in inventories ($15,820)

Increase (decrease) in accounts payable $642,359

Increase (decrease) in unearned revenue $7,698

Increase (decrease) in deposits payable $135,983

Increase (decrease) in self-insurance payable -

Increase (decrease) in net pension liability ($142,680)

Increase (decrease) in OPEB Liability ($20,962)

Increase (decrease) in deferred inflows related to pension $51,397

Increase (decrease) in deferred inflows related to OPEB $11,030

Increase (decrease) in compensated absences $15,510

Net cash provided (used) by operating activities $9,679,226

Noncash capital and related financing activities:

Contributed capital - donated infrastructure $2,496,022