Page 16 - Moreno Valley Citizen's Guide to the Budget

P. 16

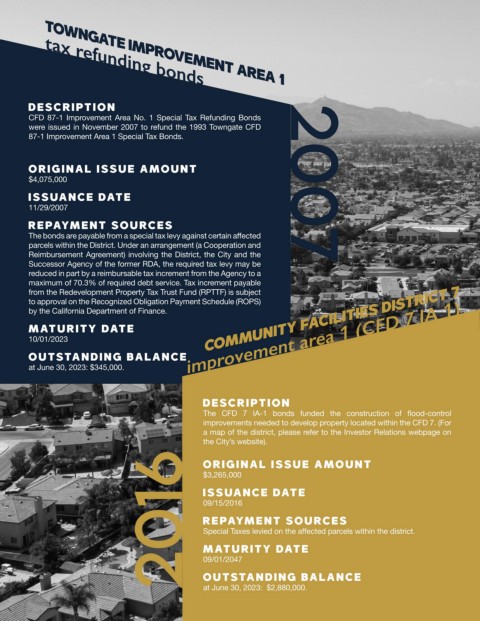

tax refunding bonds

towngate improvement area 1

description

CFD 87-1 Improvement Area No. 1 Special Tax Refunding Bonds

were issued in November 2007 to refund the 1993 Towngate CFD

87-1 Improvement Area 1 Special Tax Bonds.

Original Issue Amount

$4,075,000 2007

Issuance Date

11/29/2007

Repayment Sources

The bonds are payable from a special tax levy against certain affected

parcels within the District. Under an arrangement (a Cooperation and

Reimbursement Agreement) involving the District, the City and the

Successor Agency of the former RDA, the required tax levy may be

reduced in part by a reimbursable tax increment from the Agency to a

maximum of 70.3% of required debt service. Tax increment payable

from the Redevelopment Property Tax Trust Fund (RPTTF) is subject

to approval on the Recognized Obligation Payment Schedule (ROPS)

by the California Department of Finance. community facilities district 7

Maturity Date

10/01/2023 improvement area 1 (CFD 7 IA 1)

Outstanding Balance

at June 30, 2023: $345,000.

description

The CFD 7 IA-1 bonds funded the construction of flood-control

improvements needed to develop property located within the CFD 7. (For

a map of the district, please refer to the Investor Relations webpage on

the City’s website).

2016

Original Issue Amount

$3,265,000

Issuance Date

09/15/2016

Repayment Sources

Special Taxes levied on the affected parcels within the district.

Maturity Date

09/01/2047

Outstanding Balance

at June 30, 2023: $2,880,000.