Page 10 - Moreno Valley Citizen's Guide to the Budget

P. 10

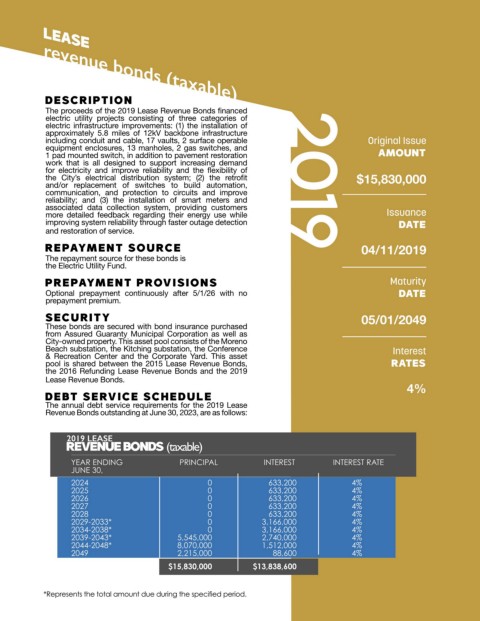

lease

revenue bonds (taxable)

description

The proceeds of the 2019 Lease Revenue Bonds financed

electric utility projects consisting of three categories of

electric infrastructure improvements: (1) the installation of

approximately 5.8 miles of 12kV backbone infrastructure

including conduit and cable, 17 vaults, 2 surface operable Original Issue

equipment enclosures, 13 manholes, 2 gas switches, and AMOUNT

1 pad mounted switch, in addition to pavement restoration

work that is all designed to support increasing demand

for electricity and improve reliability and the flexibility of

the City’s electrical distribution system; (2) the retrofit 2019 $15,830,000

and/or replacement of switches to build automation,

communication, and protection to circuits and improve

reliability; and (3) the installation of smart meters and

associated data collection system, providing customers Issuance

more detailed feedback regarding their energy use while

improving system reliability through faster outage detection DATE

and restoration of service.

repayment source 04/11/2019

The repayment source for these bonds is

the Electric Utility Fund.

prepayment provisions Maturity

Optional prepayment continuously after 5/1/26 with no DATE

prepayment premium.

security 05/01/2049

These bonds are secured with bond insurance purchased

from Assured Guaranty Municipal Corporation as well as

City-owned property. This asset pool consists of the Moreno

Beach substation, the Kitching substation, the Conference Interest

& Recreation Center and the Corporate Yard. This asset

pool is shared between the 2015 Lease Revenue Bonds, RATES

the 2016 Refunding Lease Revenue Bonds and the 2019

Lease Revenue Bonds.

4%

debt service schedule

The annual debt service requirements for the 2019 Lease

Revenue Bonds outstanding at June 30, 2023, are as follows:

2019 LEASE

REVENUE BONDS (taxable)

YEAR ENDING PRINCIPAL INTEREST INTEREST RATE

JUNE 30,

2024 0 633,200 4%

2025 0 633,200 4%

2026 0 633,200 4%

2027 0 633,200 4%

2028 0 633,200 4%

2029-2033* 0 3,166,000 4%

2034-2038* 0 3,166,000 4%

2039-2043* 5,545,000 2,740,000 4%

2044-2048* 8,070,000 1,512,000 4%

2049 2,215,000 88,600 4%

$15,830,000 $13,838,600

*Represents the total amount due during the specified period.

*Represents the total amount due during the specified period.