Measure M — Cannabis Activity Tax

At the June 19, 2018 Council meeting, City Council adopted Resolution 2018-62 submitting a Local Moreno Valley Commercial Cannabis Activity Tax to the voters (Measure M). Attached to that Resolution was an Ordinance, which would become effective if the voters approved the Local Moreno Valley Commercial Cannabis Activity Tax by a majority vote. On November 6, 2018, the voters approved Measure M by over 74%.

At the December 11, 2018 Council meeting, City Council certified the election results.

At this same meeting, City Council approved the Ordinance (No. 946) thus formalizing the addition of Chapter 3.28 “Commercial Cannabis Activity Tax” to the Moreno Valley Municipal Code to reflect the new Local Moreno Valley Commercial Cannabis Activity Tax for the City.

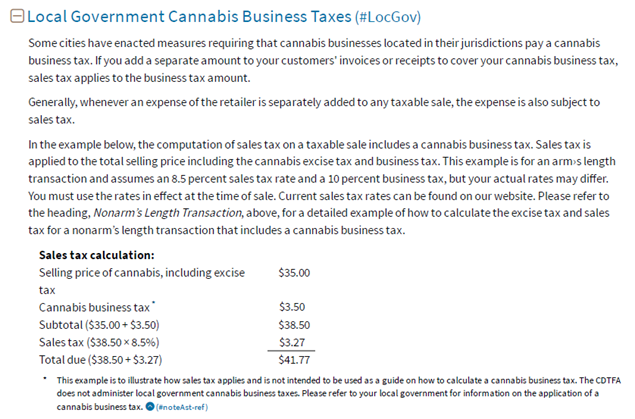

Based on the definition of “gross receipt” as defined by the California Department of Tax & Fee Administration (CDTFA) Section 6012 the sales price plus the State excise tax is included in gross receipts. Therefore, the City of Moreno Valley’s Commercial Cannabis Activity Tax is calculated in the same manner as illustrated under the Local Government Cannabis Business Taxes section of the CDTFA Tax Guide for Cannabis Businesses, which a screen shot is also below:

Questions?

Visit our Frequently Asked Questions (FAQ) page to learn more. If you have additional questions, email cannabispermit@moval.org.